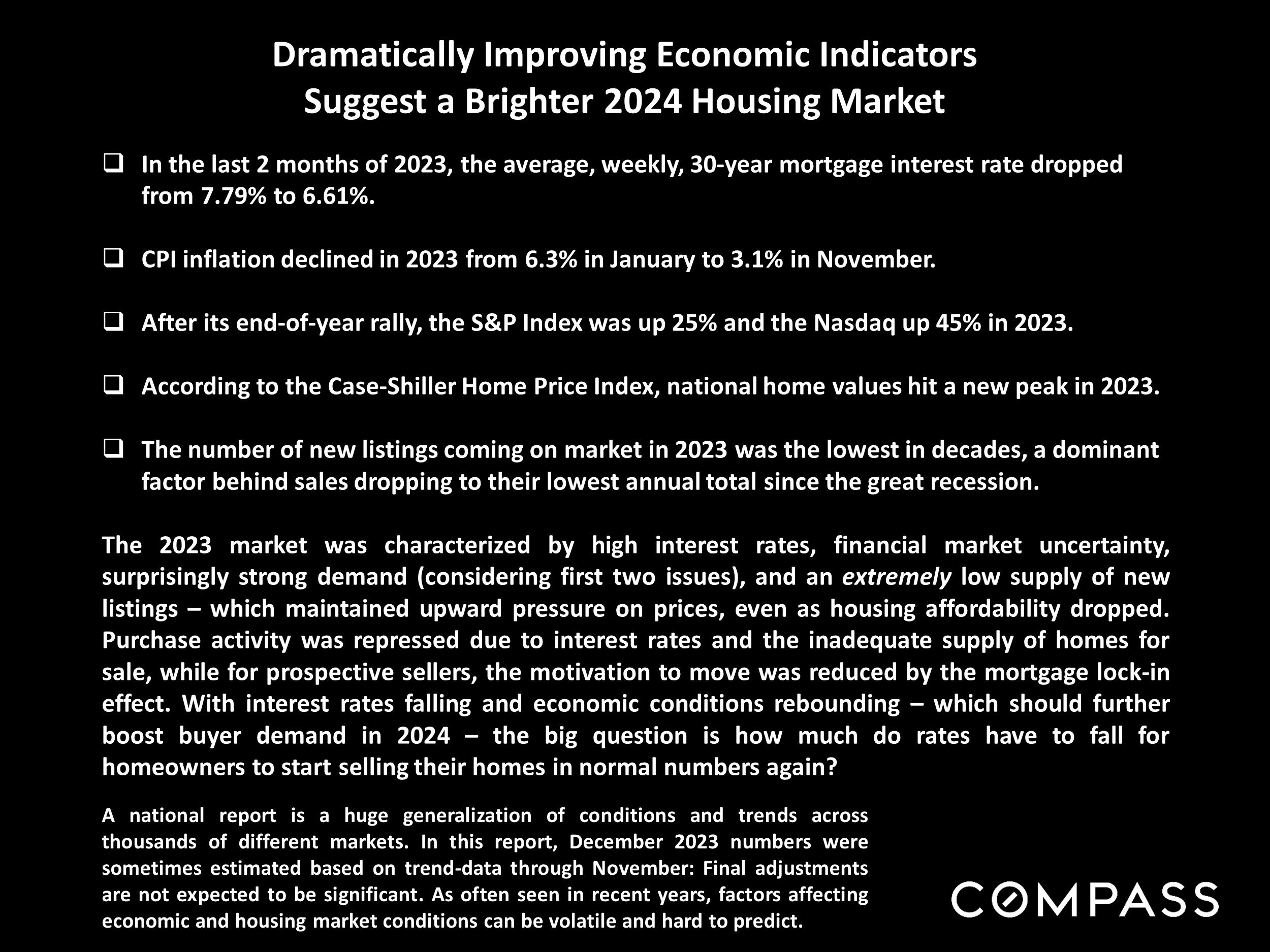

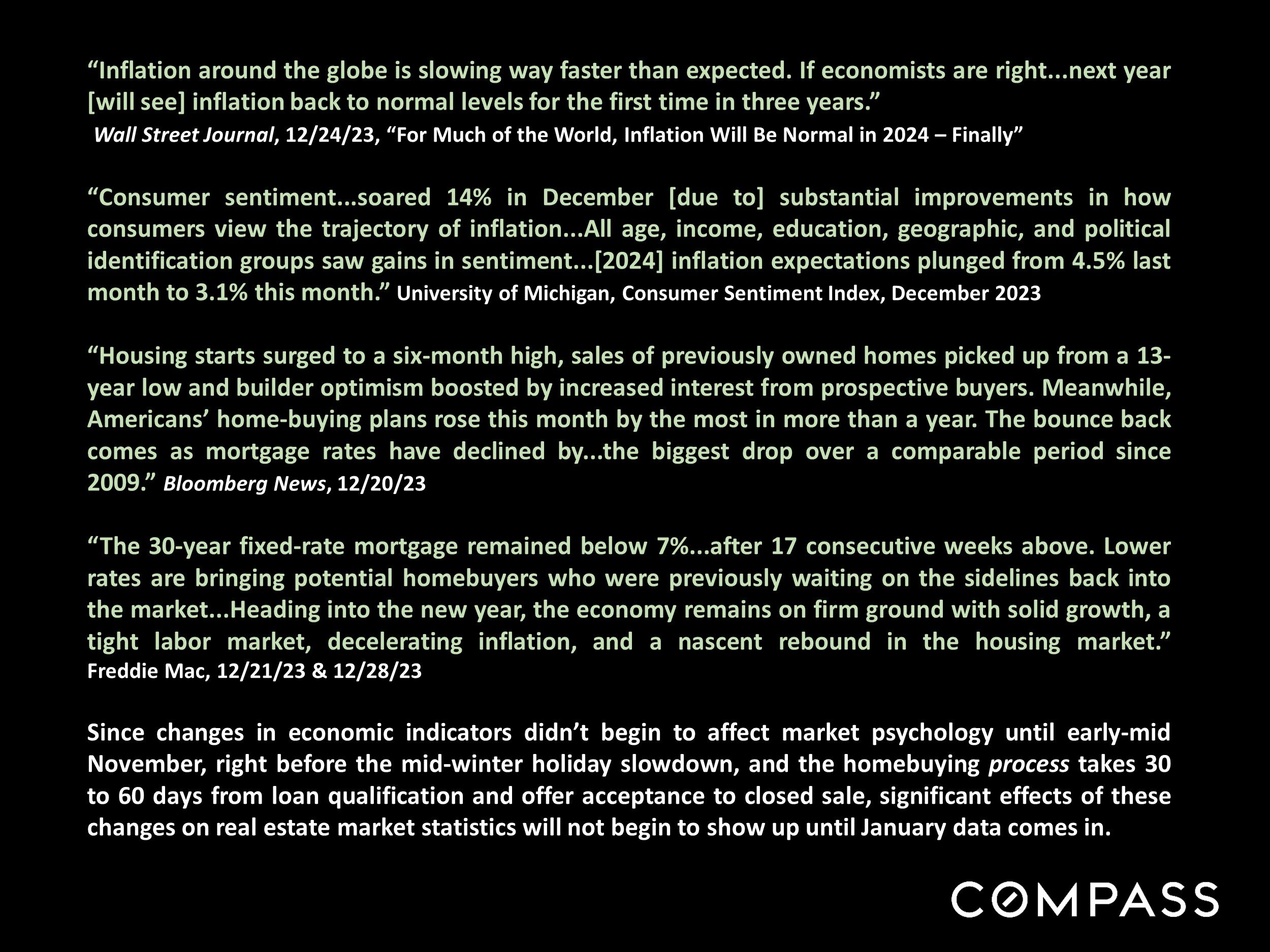

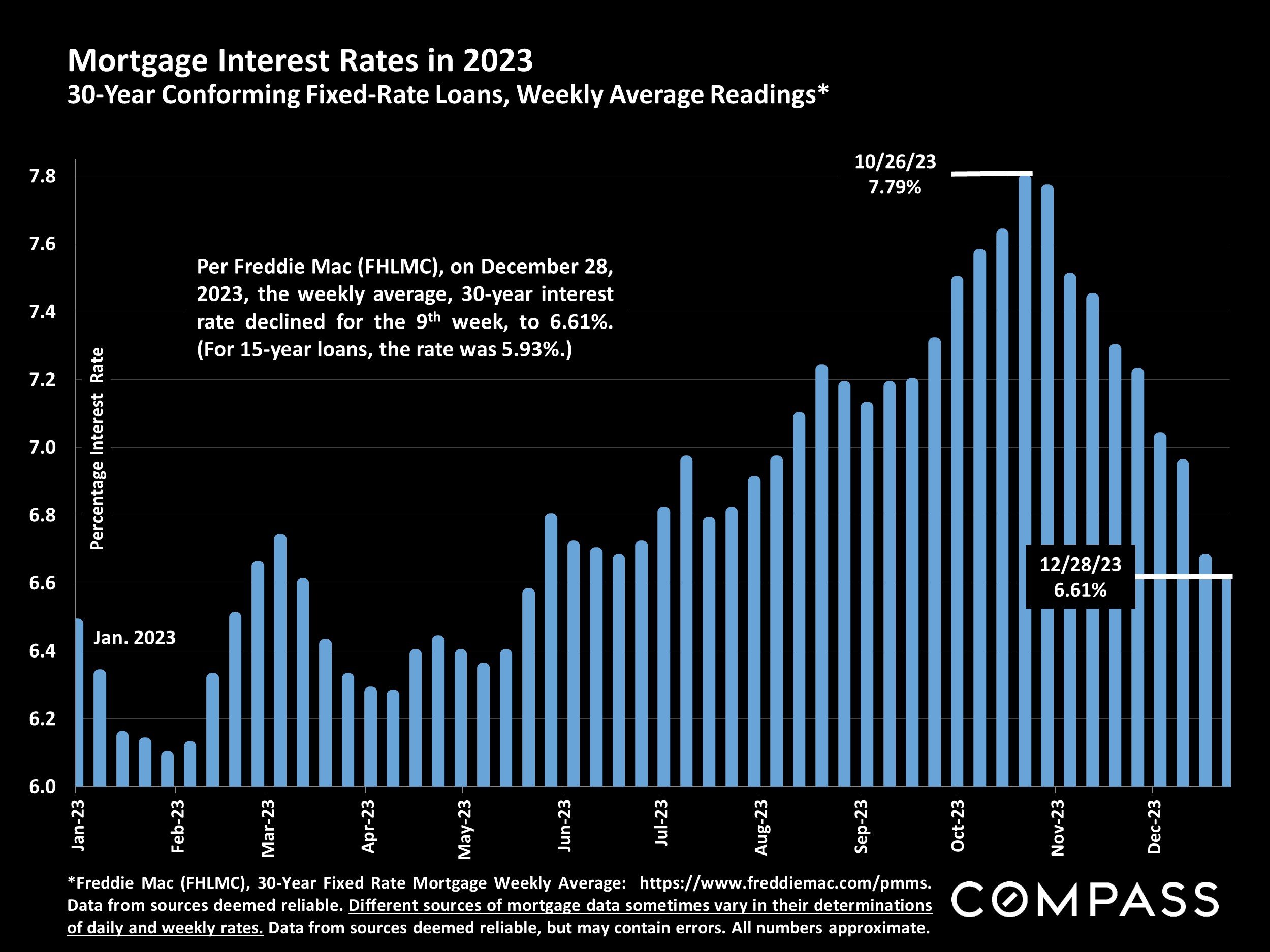

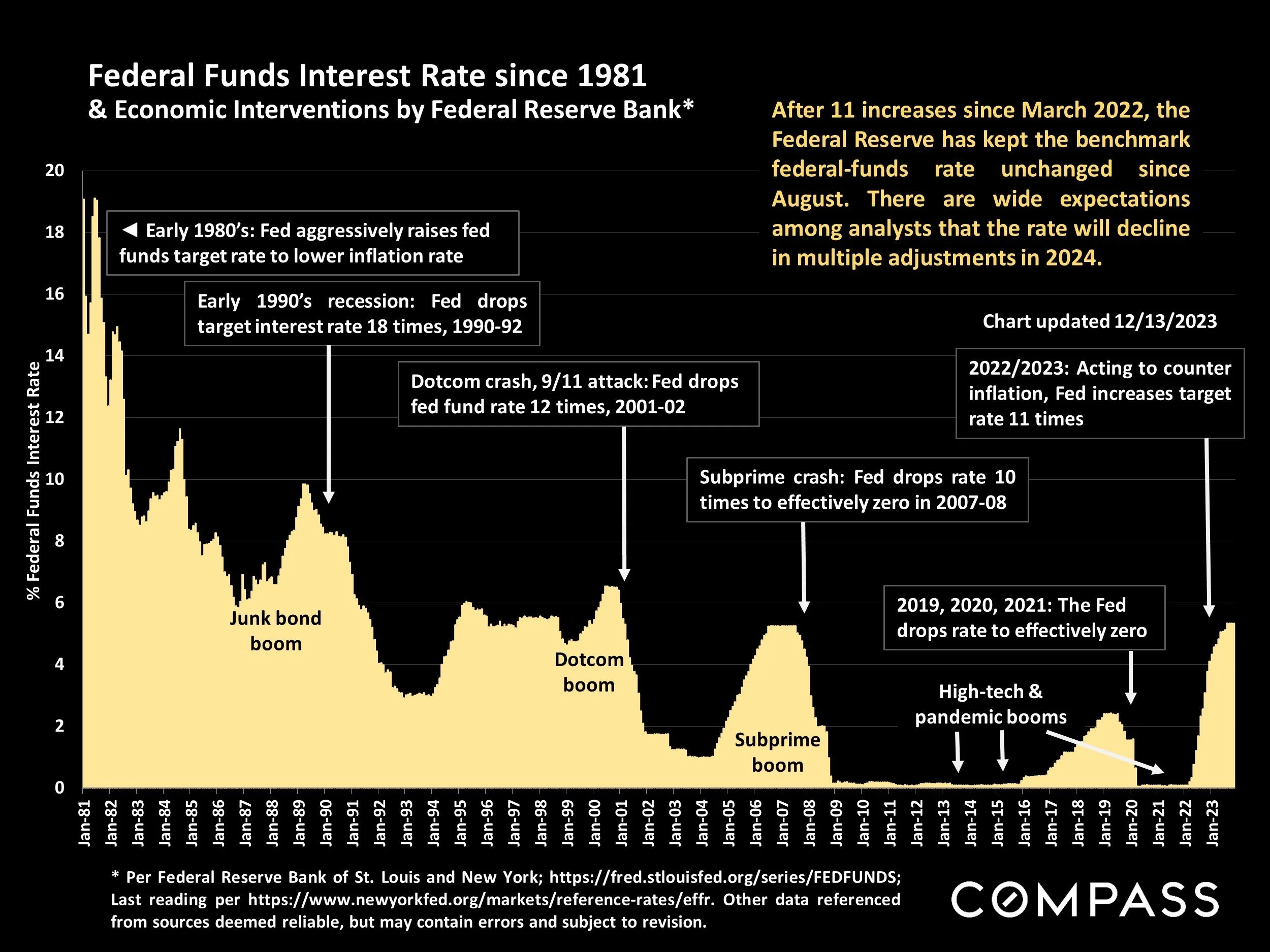

Interest rates have plunged since October,

and are currently expected to drop further in 2024.

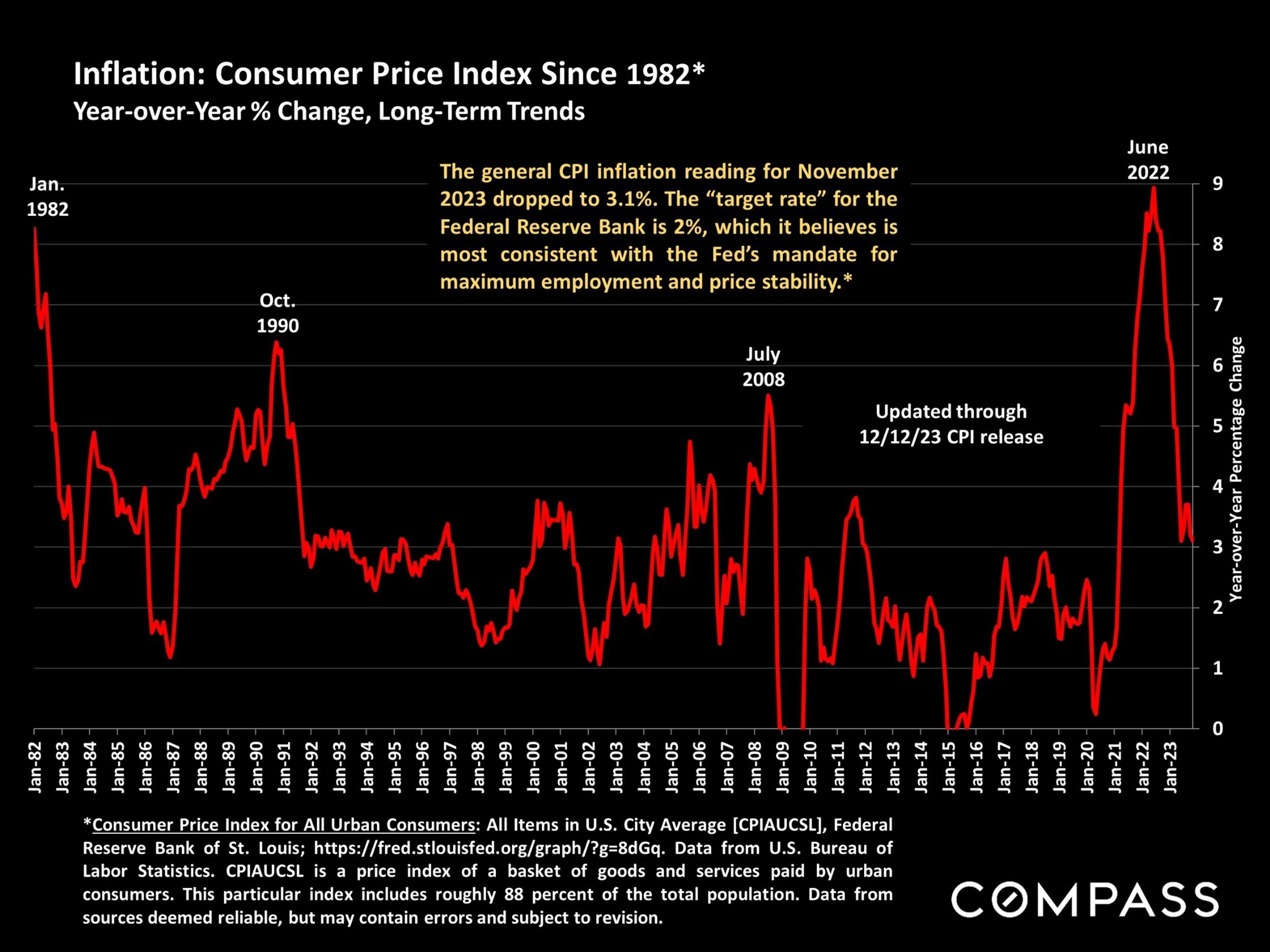

Inflation is a huge factor in interest rates, consumer confidence, and housing and financial markets. Most analysts believe inflation will continue to fall in 2024.

Consensus opinion is that the Fed will soon begin to drop its benchmark rate. Once it determines a change is appropriate, the Fed often acts quickly and decisively.

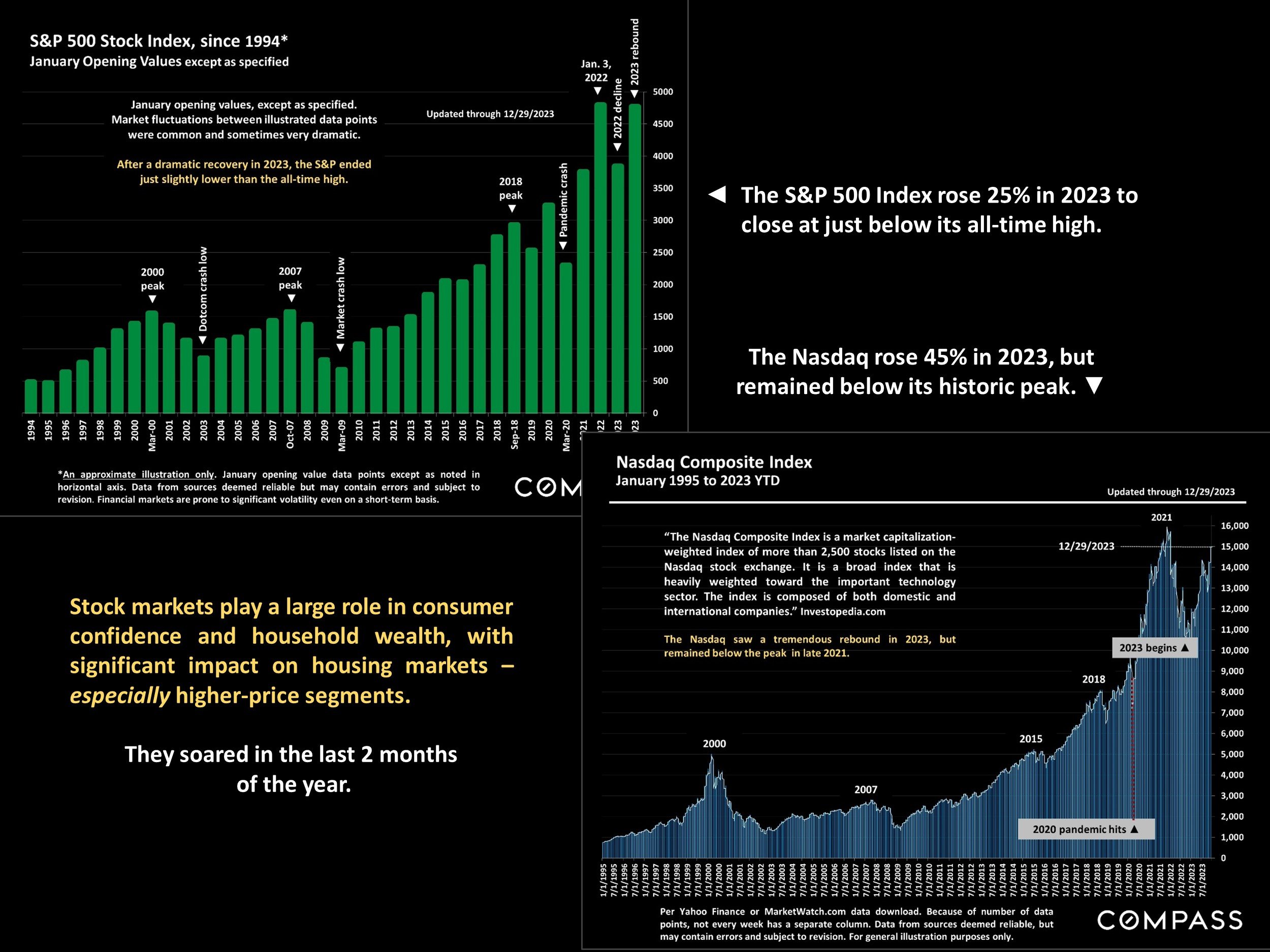

Rarely have stock markets swung so dramatically from pessimism regarding economic trends to ebullient optimism as in the last 2 months of 2023.

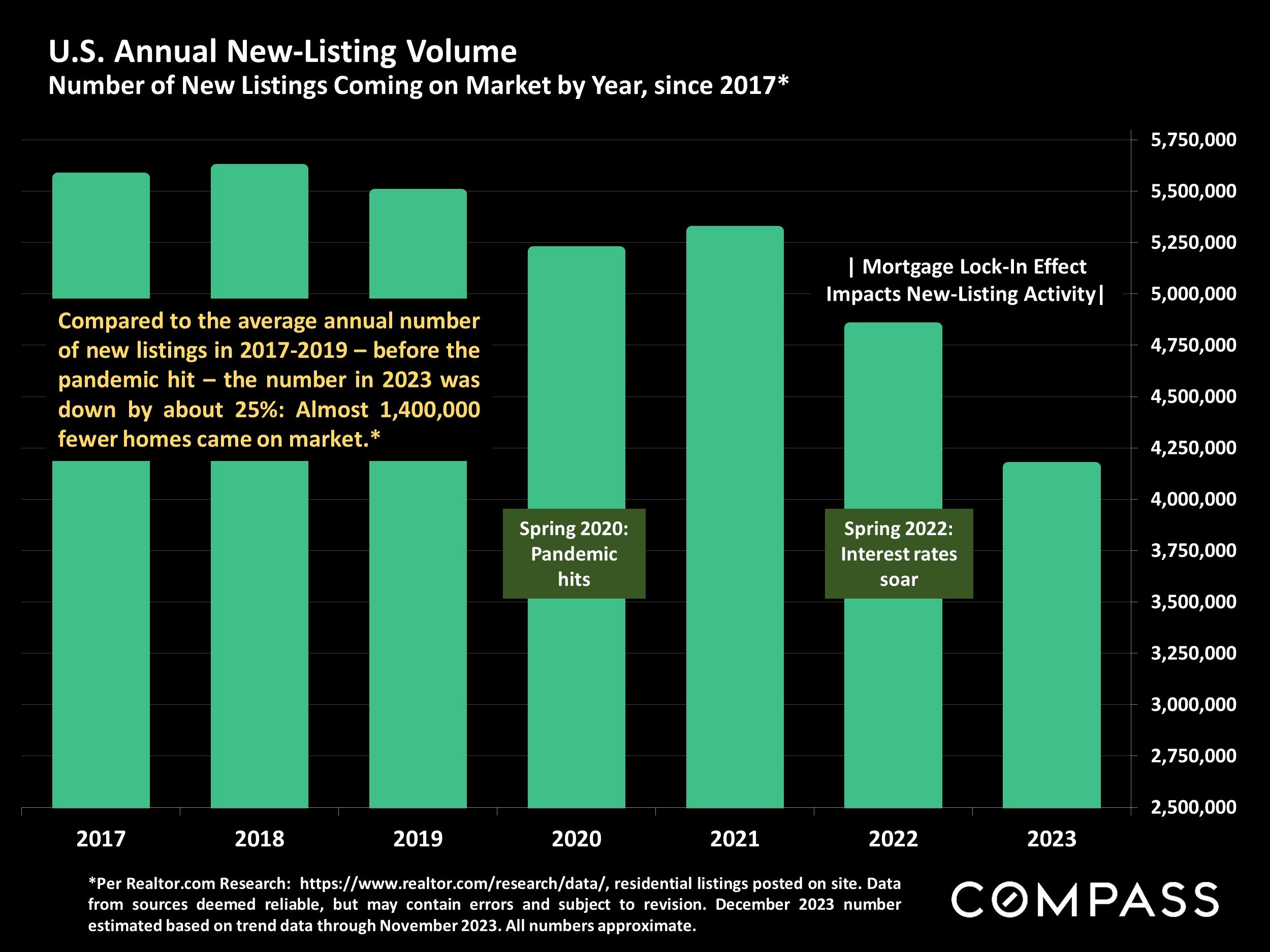

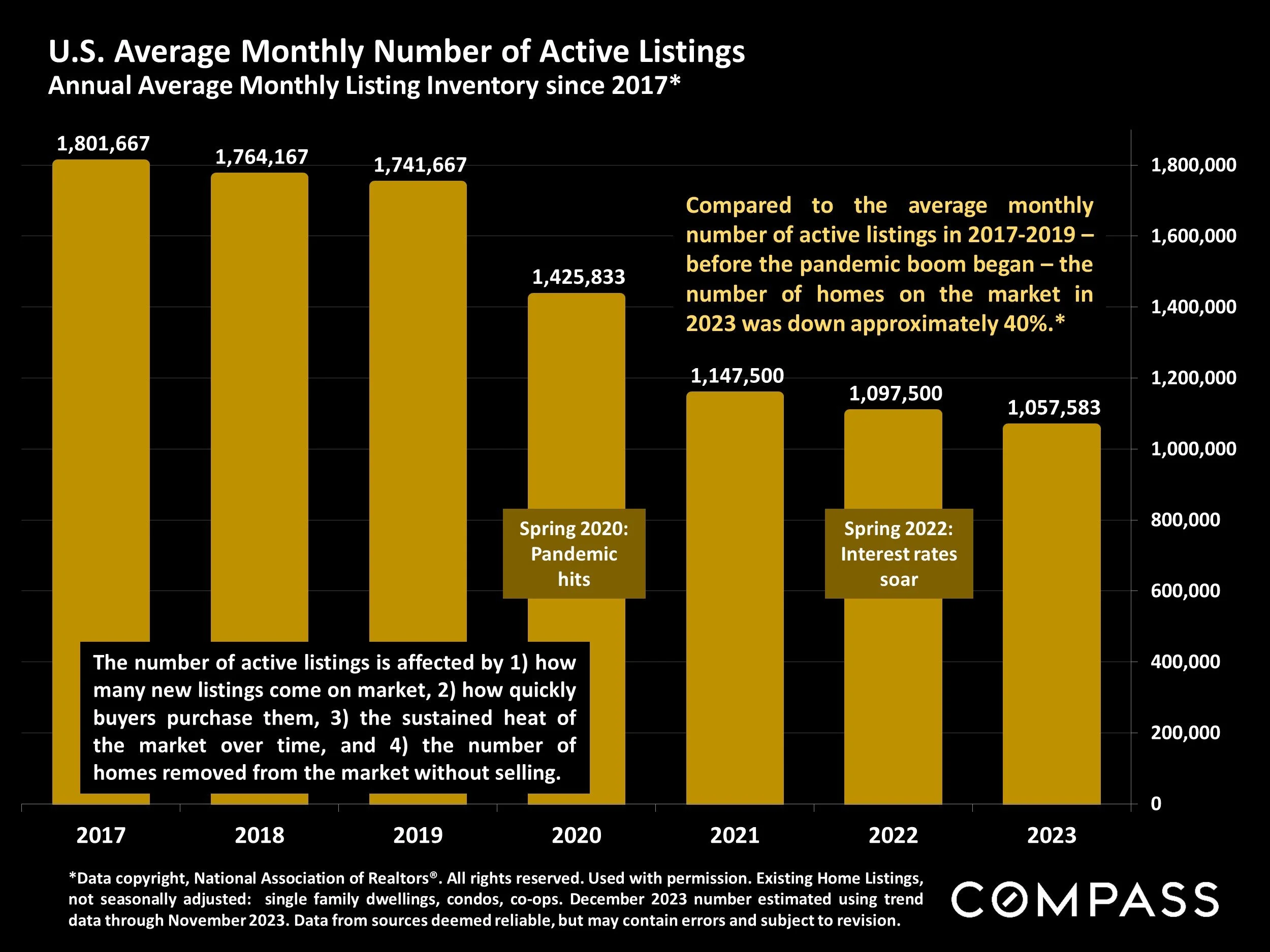

The effect of high interest rates on the number of new listings coming on market has had a staggering impact on supply & demand dynamics.

Even as rising interest rates negatively affected affordability, the extremely low supply of homes for sale has maintained upward pressure on home prices.

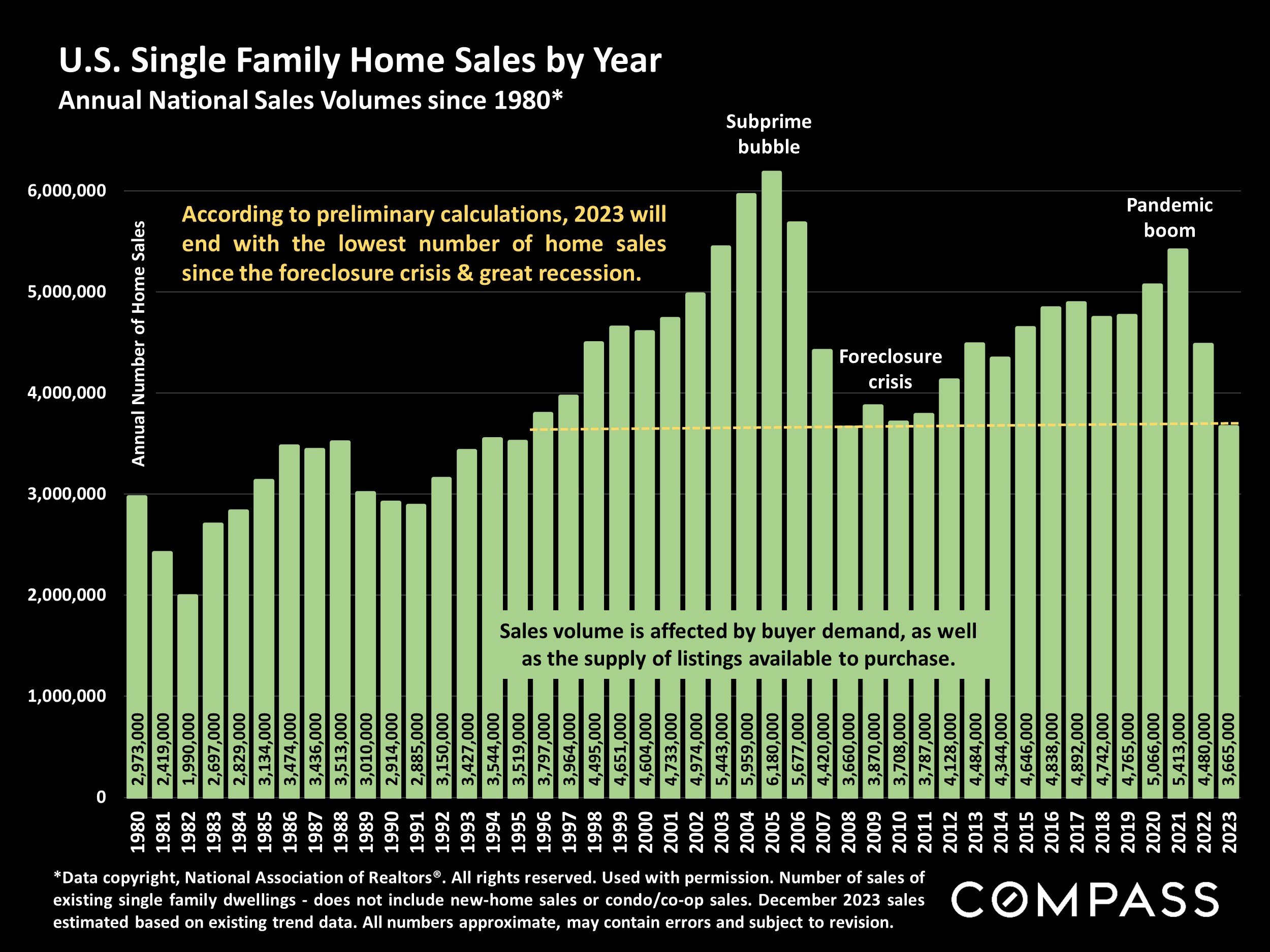

Home sales plunged in 2023, but if economic conditions continue to improve as currently forecast, both supply and demand should rise in 2024.

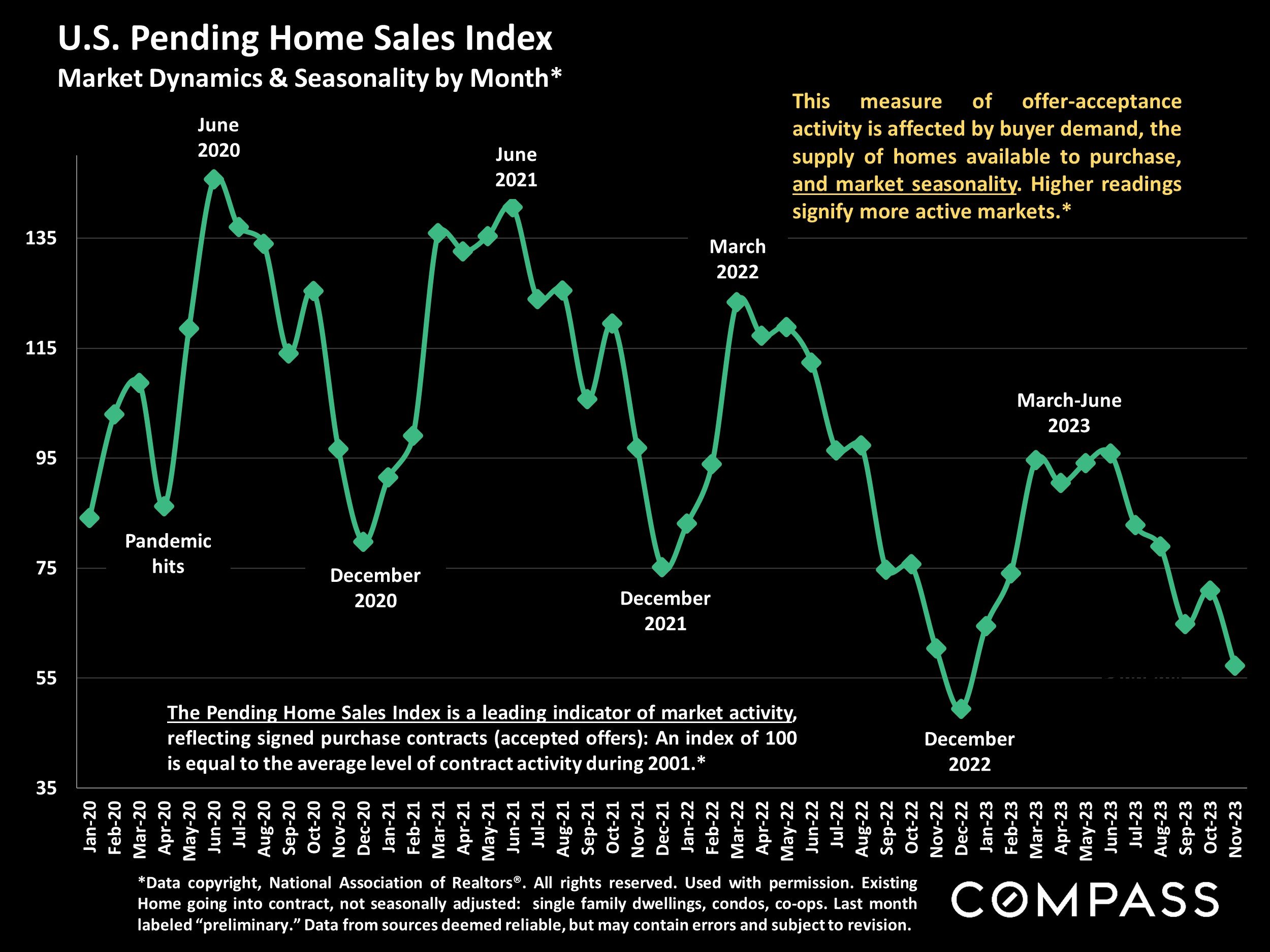

Monthly accepted-offer activity, seen below, highlights the effects of market seasonality. Activity usually picks up rapidly in the 1st quarter to peak in spring.

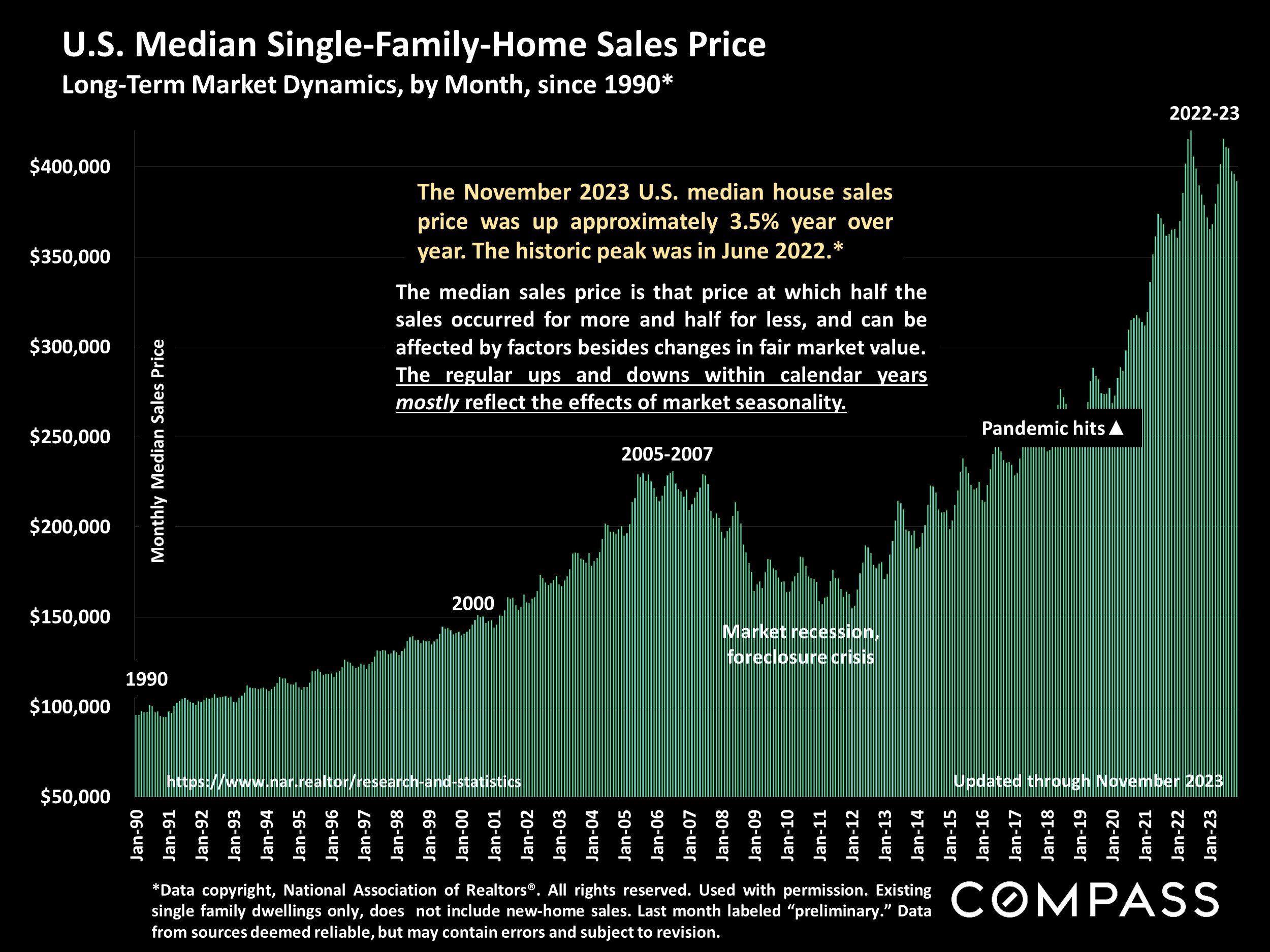

A long-term illustration of national median house sales prices - which defying expectations, saw a strong recovery in 2023 after the mid-2022 plunge.

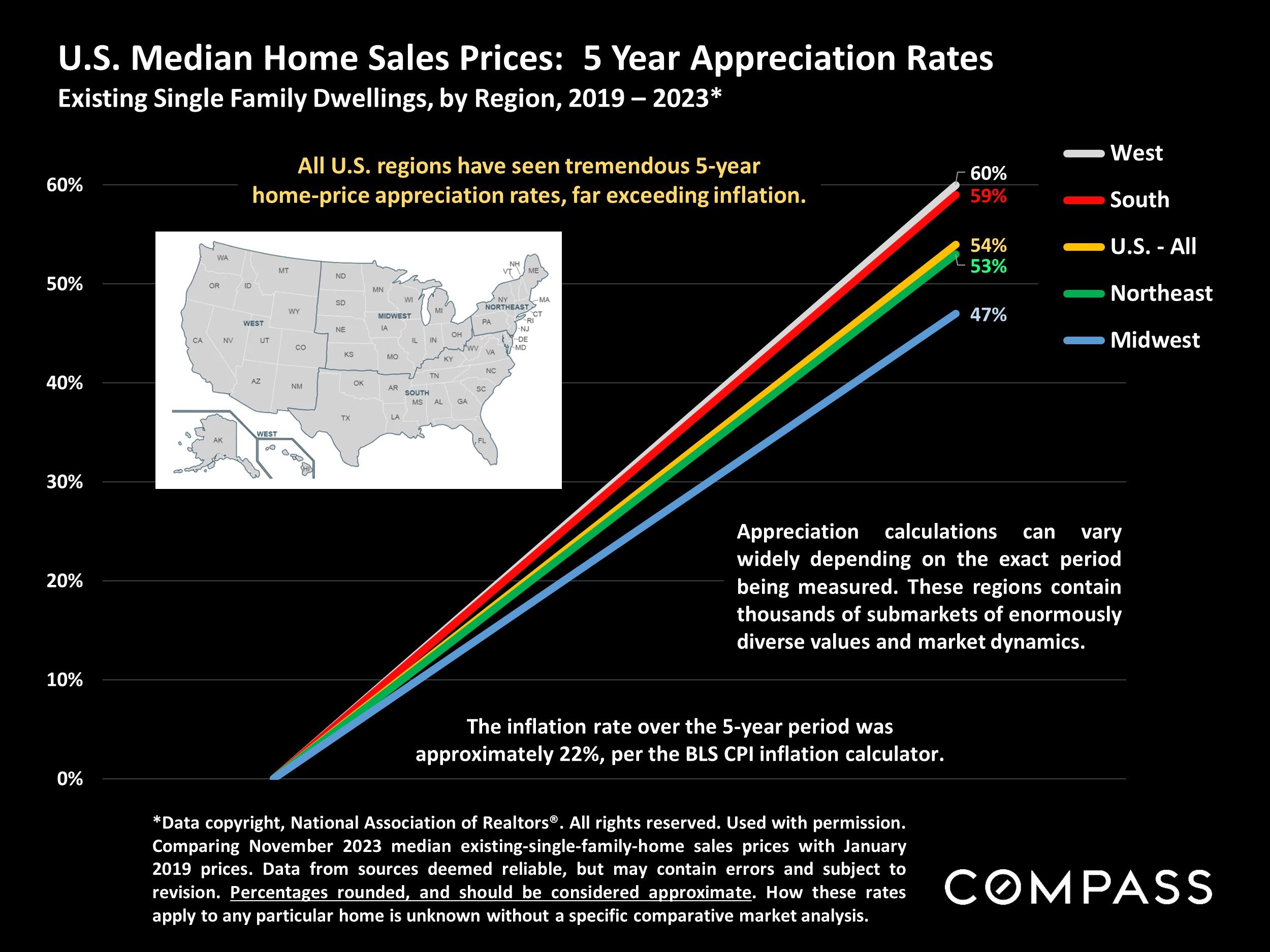

Across all national regions, there has been very substantial

home price appreciation over the past 5 years.

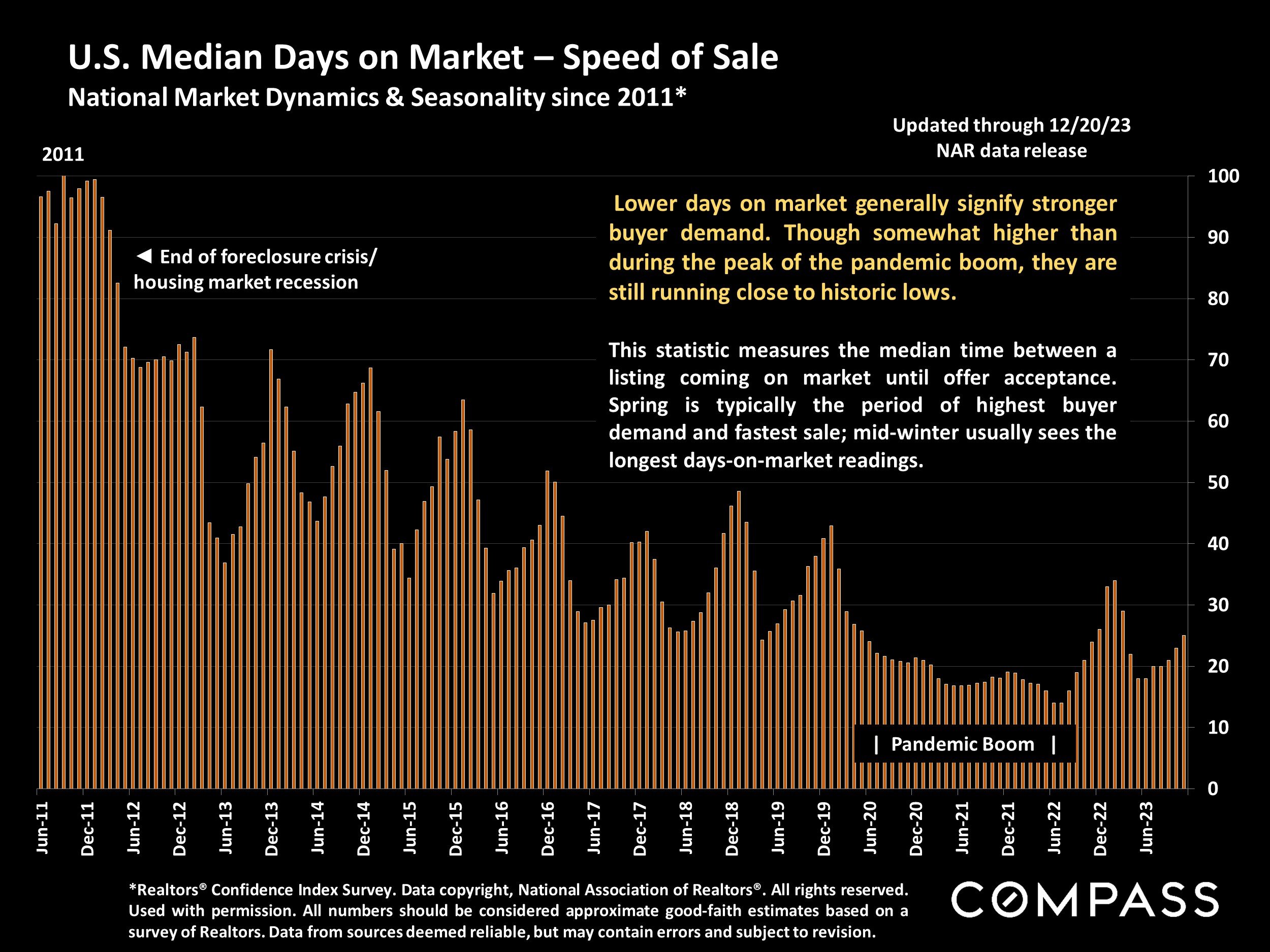

Speed of sale is mostly determined by the intensity of buyer demand as compared to supply. Median days on market remain very low by long-term standards.

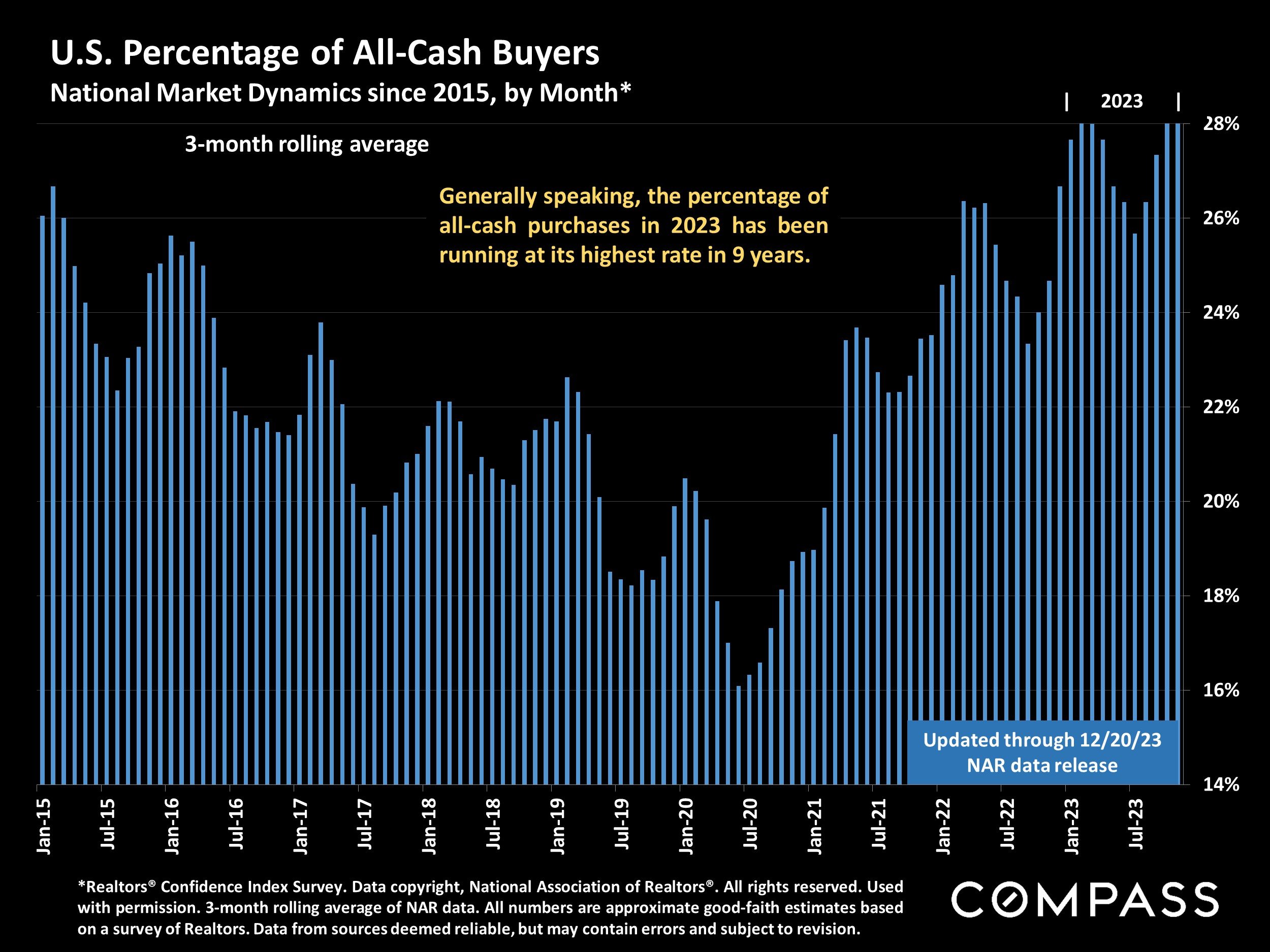

As interest rates rose, so did the percentage of all-cash buyers - who have played an increasing role in supporting demand and home prices.

Let's talk more about the potential for property appreciation and the stability of the local real estate market in Montecito for 2024. Wishing you and yours a safe, happy, healthy and prosperous 2024!